Did We REALLY Raise Them to Be Like That?!

As we examine entitlement, it’s clear this isn’t just a recent issue in earth’s history. Many families have experienced the druthers of entitlement. In the Bible, in Luke 15, for example, the famed parable of the prodigal son reveals how two sons used their inheritance differently. In addition, the parable of the lost coin and the story of the lost sheep. Beyond the parables, there are several examples of real-world family governance gone wrong—or right. In the eighteenth and nineteenth centuries, two prominent families demonstrated the difference between entitlement and empowerment. Keep reading to learn who these families are and how they cultivated abundance or enabled scarcity within their posterity.

**Please note we are not endorsing nor criticizing one family over another. We are simply offering their differing approaches as a way to look at how generational wealth can be dissipated or accumulated over time.

Vanderbilt Vanishing Act vs. Rothschild Rewards

Cornelius Vanderbilt

Cornelius Vanderbilt

Cornelius Vanderbilt was born in 1794, the son of humble farmers who eked out a living on Staten Island, N.Y. With very little schooling as a boy, he began working alongside his father, who also ferried cargo between Staten Island and Manhattan on a small sailing ship. Cornelius eventually worked as a steamship captain, and in the 1820s went on to start his own business.

He became one of the country’s largest steamship operators, and by the 1860s he branched into the railroad industry. Nicknamed the Commodore, he was known for being a fierce businessman, unafraid of ruthlessness when he felt the situation required it.

By the time he passed away, he was worth more than $100 million—the largest individual fortune in American history up to that time. He had thirteen children, and was said to have told his son, William “Billy” Henry Vanderbilt, “Any fool can make a fortune; it takes a man of brains to hold onto it.

Billy was able to grow that fortune to over $200 million in his lifetime.

When Billy passed away, the stake was divided between his own two sons, and this third generation is where things started to shift.

Today, Cornelius’s home in Manhattan is occupied by the retailer Bergdorf Goodman, and Anderson Cooper, CNN anchor and sixth generation Vanderbilt, told radio host Howard Stern, “My mom’s made clear to me that there’s no trust fund.”

Mayer Amschel Rothschild

Mayer Amschel Rothschild

The Rothschild family, on the other hand, perpetuated its family wealth for several generations. Mayer Amschel Rothschild was born in Frankfurt, Germany, in 1743. He started his business by dealing in coins and antiques.

He began extending credit to customers and dealing in foreign currency trading and government loans, eventually founding a banking dynasty. He had ten surviving children— five of them sons, who all joined him in the family business spread across Europe. As their wealth and prominence grew, a French journalist wrote: “There is but one power in Europe and that is Rothschild.”

Mayer taught his five sons conservative money management by making investments that produced reasonable profits rather than aggressive returns. They continued their family wealth for generations by establishing the following system:

- They loaned their heirs money or entered into joint ventures.

- The loans had to be repaid to the “family bank.”

- The knowledge and experiences those heirs gained had to be shared with other family members.

- Family members gathered at least once a year to reaffirm virtues and intentions, or they couldn’t participate in the family bank.

Subsequently, the Rothschilds’s wealth compounded and grew as it passed to future generations—an example of family management done right.

While things are rarely black and white, there are two very distinct ways of approaching life that can have a significant impact on every aspect of our lives. You can see it play out with the Vanderbilts and the Rothschilds: the difference between a scarcity mindset and an abundance mindset.

Abundance vs. Scarcity

Looking at the Vanderbilts, you can see how the scarcity mentality wreaked havoc, with the third and subsequent generations eventually exhausting the family’s resources. On the other hand, the Rothschilds leveraged their abundance mindset to empower each generation with accountability, and they went on to contribute to and multiply the family wealth.

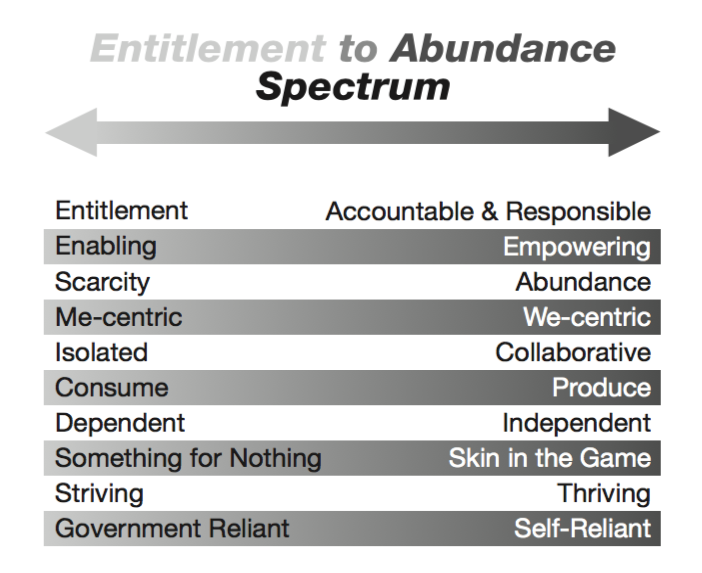

On the chart here you can see some mindsets of both scarcity and abundance.

Ask yourself, “where is my family, today, on the Entitlement to Abundance Spectrum? Are we headed in the direction of the Vanderbilts, merely hoping that by passing along our wealth and means, our posterity will manage it well? Or are we like the Rothschilds, putting systems and expectations into place to ensure our family will continue to cultivate what we’ve achieved and pass it on for generations to come?”

The Entitlement Abolition Kit

Families are hungry for guidance and reinforcement in making the cultural shift necessary to open the way for abundant living. That's why we've written Entitlement Abolition, to become your coach along the way. In addition to the book, (if you haven't picked up your copy yet, click here) we have developed The Entitlement Abolition Kit. The Entitlement Abolition Kit serves as a “virtual, digital Legacy Coach,” a do-it-yourself guide to incorporating these principles. Because we believe there are four primary ways to combat entitlement, we've created four modules that focus on these four areas of transformation:

Module 1: Habits of Abundance

Module 2: Developing Your KASH Blueprint

Module 3: Family Retreats with a Purpose

Module 4: Building Your Legacy Bank

To learn more about The Entitlement Abolition Kit and how it will help you create

a culture of abundance within your family, click the button below.